Business Impacts and Recommendations

Halloween is coming, and with it, fear. Business and individuals across the UK are waiting nervously for that Chancellor Rachel Reeves is likely to do. Here we look at what is likely, what it means and what businesses, particularly SMEs, can do about it.

The Chancellor is positioning the government and Treasury as being under pressure to balance fiscal responsibility and economic growth, and is apparently looking at potential changes in taxation, regulation, and spending. Whilst changes to inheritance tax, CGT and VAT on school fees may affect individuals, the key focus areas for businesses include changes to National Insurance (NI), business taxes, and capital expenditure incentives.

Key Predictions

Employer National Insurance Contributions (NICs)

One of the most likely areas for change is an increase in employers’ NICs. Although Labour had pledged not to increase NI, this has now shifted to being positioned as not increasing it for employees. It is therefore almost certain that employer contributions may rise. A 1% increase in employers’ NICs could raise significant revenue, estimated at £8.5 billion annually. Additionally, there are concerns that NICs could be extended to employer pension contributions, which could raise around £17 billion but thereby significantly increase employment costs.

Capital Gains Tax (CGT)

Although Labour initially dismissed the idea of significantly aligning CGT with income tax, there is still speculation that CGT rates could increase. Currently, the CGT rate for higher earners is 20%, but raising this closer to income tax rates (40%-45%) could generate much-needed revenue. However, there is a real risk that this could discourage investment, particularly for small businesses and entrepreneurs who are also likely to be impacted by other changes such as VAT on school fees and increases to inheritance tax.

Business Tax Roadmap

The government has indicated that it will introduce a business tax roadmap. This plan is expected to focus on stability and predictability in business taxation, with the aim of encouraging long-term investment. The headline rate of corporation tax is set to be capped at 25% for the duration of the Parliament. Additionally, the Full Expensing scheme, which allows businesses to deduct 100% of capital investment costs from profits, is expected to become permanent.

Business Rates Reform

Labour’s manifesto promised to address the “unfairness” of the current business rates system, particularly for high street businesses competing with online giants. Although specifics are lacking, the budget may include early steps toward a more equitable system. However, any meaningful changes are expected to be gradual.

Impact on Businesses, Particularly SMEs

Increased Employment Costs

Any rise in employers’ NICs will disproportionately impact SMEs, who already face tight margins. For labour-intensive businesses, such as those in hospitality, retail, and healthcare, the increased cost of employment could lead to higher operational expenses and reduced hiring. Combined with increased employment rights from day one, and less flexibility on using zero-hour contracts, this is almost certain to lead certain businesses, particularly in the industries mentioned, to reduce headcount, put off hiring and look for other ways to achieve their business goals. For those industries able to do so, it is likely to drive increased investment into automation in a bid to avoid hiring increasingly costly staff.

Investment and Growth Uncertainty

While the business tax roadmap aims to provide long-term stability, concerns remain about how changes to CGT and NICs might stifle investment, particularly for SMEs reliant on capital gains from selling business assets. SMEs in sectors like real estate or technology are likely to face reduced incentives to grow or innovate due to the higher tax burden.

Operational Pressures from Business Rates

High street retailers and small businesses in bricks-and-mortar locations could benefit from reforms to the business rates system. However, the slow pace of change means they may continue to face competitive pressures from online businesses in the short term. SMEs that operate in both physical and digital spaces will need to prepare for a long period of transition before any tangible relief is seen.

Recommendations

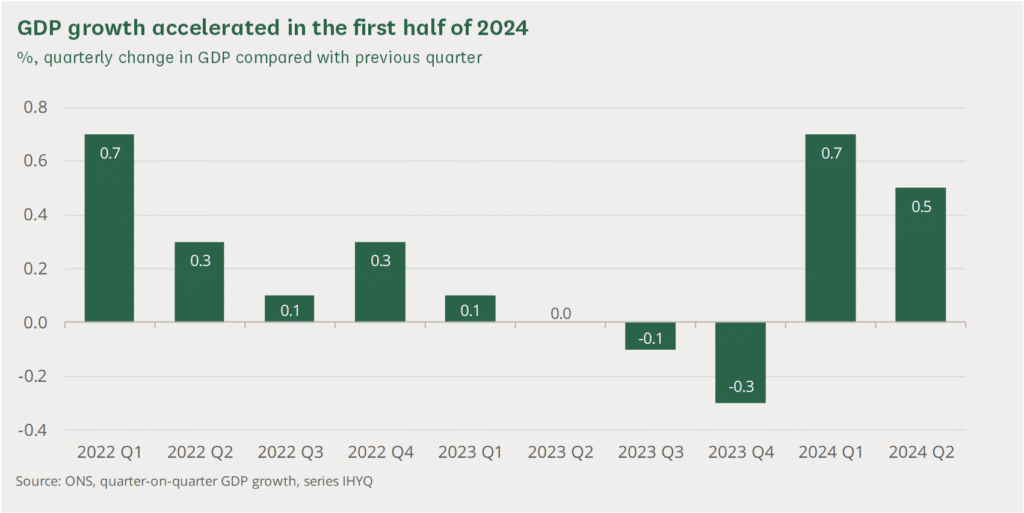

What can you do to prepare and to manage the impact of the changes? First of all, look at the big picture. Despite an increasing tax burden, the UK economy is in good an improving health. After contracting a little in the second half of 2023, it grew 0.7% in Q1 2024, and 0.5% in Q2 2024. All signs are that it is and will continue to grow through 2024 and into 2025.

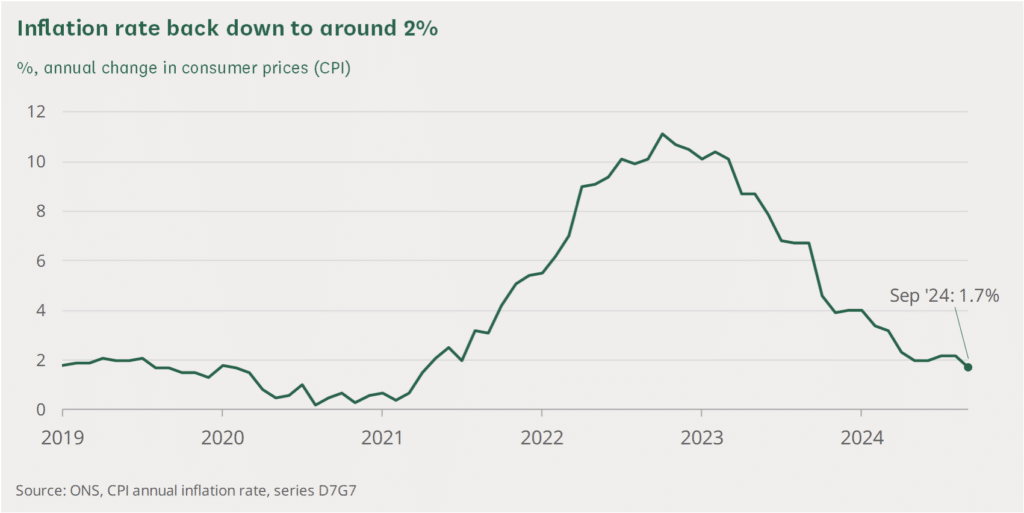

At the same time, inflation is falling, and interest rates are expected to follow. Consumer prices were up 1.7% in September 2024 compared with the same time the year before, much lower than seen in recent years, boosting household incomes. Finally, average wages, helped by generous payouts to public sector workers, are rising significantly faster than prices.

This is all making capital available to spend. Yes, costs to business will increase, but there is every potential to increase income too, to match and surpass it. It will require swift and decisive action by businesses. Those that batten down the hatches and wait, risk missing the opportunities and being left with all of the down-side and none of the up.

Specific things businesses should do in the short term include:

Prepare for Higher Employment Costs

If NICs on employer contributions rise, businesses should review their payroll structures and assess the impact on their overall costs. To offset these expenses, they can consider revising employee benefit packages, improving operational efficiencies to boost productivity, and look at investing in automation.

Key actions in this area include consulting with HR and financial advisors to implement strategies like salary sacrifice arrangements more effectively, and with the former to look at programme and training to driving productivity gains and improve management effectiveness.

Reassess Investment Strategies

With uncertainty around potential CGT hikes, business owners may want to reassess their exit or investment plans. If you are planning a business sale or capital investment, consider accelerating these processes to take advantage of current, lower CGT rates. If CGT increases, tax-efficient investment vehicles, such as SEIS or EIS, might offer alternative ways to raise capital or invest.

Focus on Capital Expenditure

The permanence of Full Expensing is an opportunity for businesses to boost productivity by investing in capital assets. SMEs should evaluate their current assets and consider taking advantage of this tax relief by upgrading technology, equipment, or infrastructure, which could lead to long-term cost savings and improved efficiency.

Plan for Business Rate Adjustments

High street businesses should monitor announcements regarding business rate reform closely. While changes may be gradual, proactive planning, such as improving e-commerce capabilities or adjusting property portfolios, will help businesses remain competitive. It’s also important to engage with local business networks to stay updated on potential regional reforms.

At Quarsh, we understand how the upcoming October 2024 Budget changes could impact your recruitment needs. Let’s discuss how we can support your recruitment goals through these changes. Complete our contact form below or email us at hello@quarsh.com to start the conversation.